2025 Roth Ira Contribution Limits Catch Up Limit

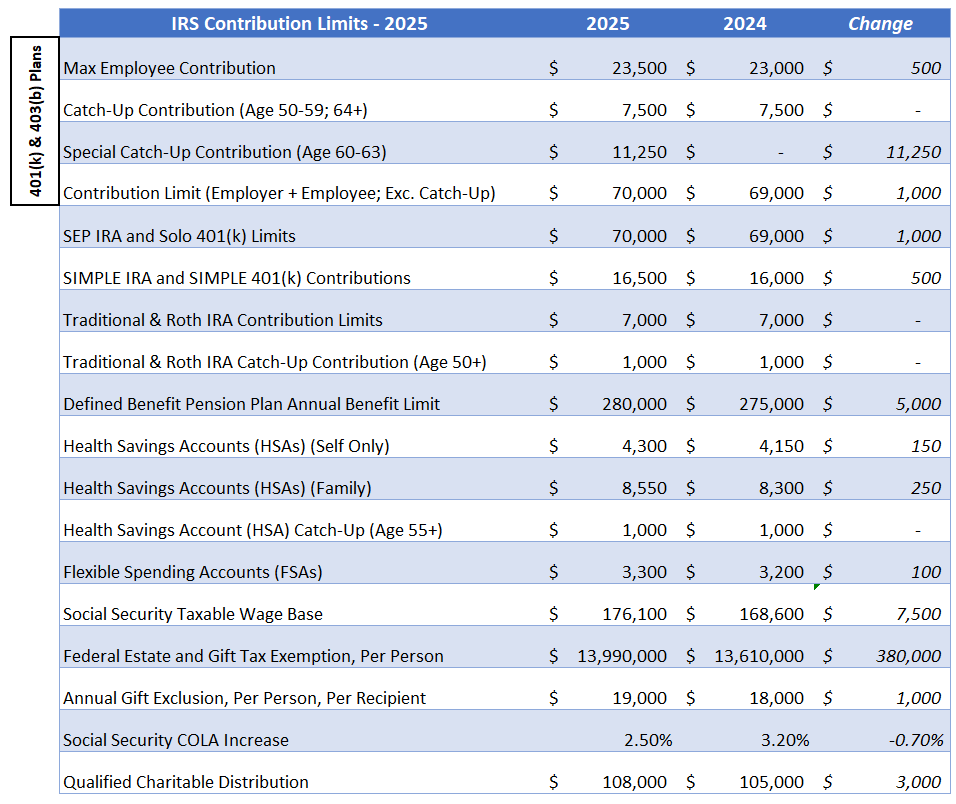

2025 Roth Ira Contribution Limits Catch Up Limit. For 2025, eligible taxpayers can contribute $23,500 to their 401(k) account, up from $23,000 in 2025. No increase for regular ira contributions.

Individuals under 50 can contribute up to $7,000, while. The internal revenue service (irs) announced 2025 retirement plan contribution limit adjustments.

Roth Ira Max Contribution 2025 Limits Laila Hope, For 2025, eligible taxpayers can contribute $23,500 to their 401(k) account, up from $23,000 in 2025.

Roth Ira Limits 2025 Catch Up Zaina Claire, The contribution limits for a traditional or roth ira increased last year but remain steady for 2025.

Roth Ira Contribution Limit In 2025 Sebastin Cole, The contribution limits for a traditional or roth ira increased last year but remain steady for 2025.

Limits For Roth Ira Contributions 2025 Lily Salma, The 401(k) contribution limit for 2025 is $23,500, up from $23,000 in 2025.

Ira Contribution Limits 2025 Irs Ezra Bilal, Here’s a breakdown of the estimated ira contribution limits for 2025, along with some other key retirement accounts:

Ira Contribution Limits 2025 Fernando Tate, The contribution limits for iras in 2025 remain unchanged from 2025.

2025 IRS Contribution Limits For IRAs, 401(k)s & Tax Brackets, The 401(k) contribution limit for 2025 is $23,500, up from $23,000 in 2025.

Limits For Roth Ira Contributions 2025 Antonio Porter, You can contribute a maximum of $7,000.

2025 401(k) and IRA Contribution Limits Modern Wealth Management, The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older.